1099 Template

Add details of the business you are working for. IRS Form W-9 should be given to the independent contractor and have completed before signing any agreement.

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

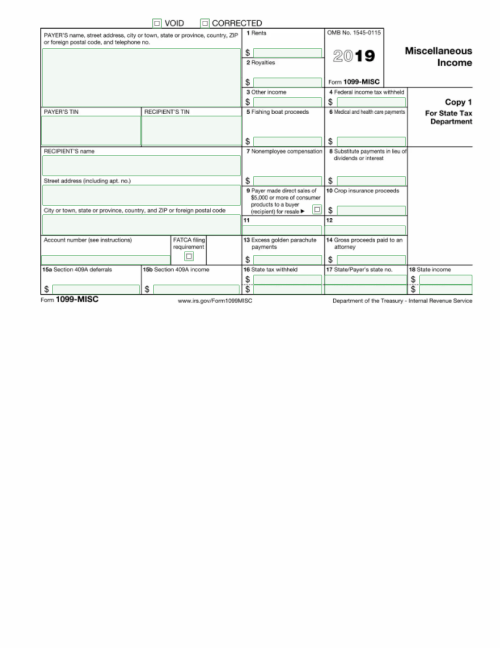

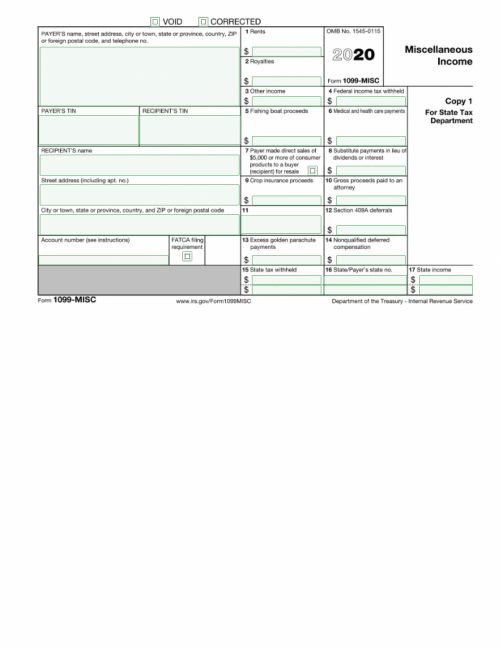

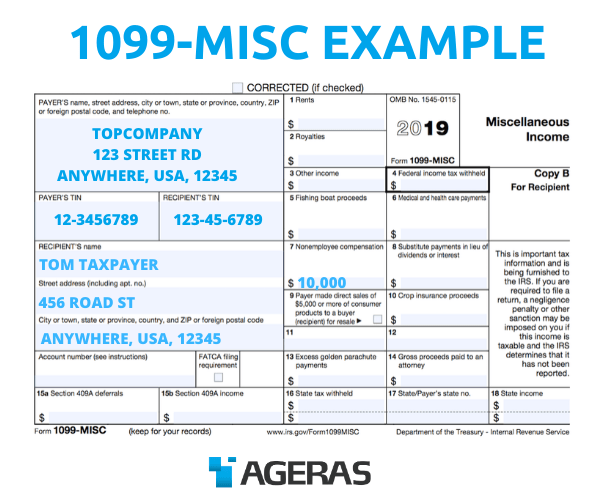

Form 1099 Misc Miscellaneous Income Definition

An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer.

. Name of the business contact number and address. In most cases the invoice will include a combination of labor and materials used. There is a rule that you must issue a Form 1099-MISC to any person you have paid at least 600 a year in royalties prizes awards attorneys fees and other income.

PDF files you download from the IRS website cant be used to print recipient or IRS 1099 forms. Filling out the 1099-NEC form is easy with this fillable Word template just open the Word template enter the recipients information and print. Persons with a hearing or speech disability with access to TTYTDD equipment can call 304-579-4827 not toll free.

Provide details of the services you have rendered. Payments to an attorney. Clients are not responsible for paying the contractors taxes.

In addition use Form 1099-MISC to report that you made direct sales of at least 5000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment. Independent Contractor 1099 Invoice Template. This will identify themselves and require to give their Employer Identification Number EIN or Social Security Number SSN before performing any work.

Examples of income reported on a 1099-Misc include payments to an attorney health care payments royalty payments and substitute payments a person receives instead of dividends. A 1099-Misc form is a tax form used to report miscellaneous payments that a company made for the reporting tax year. Generally the cash paid from a notional principal contract to an individual partnership or estate.

1099-A call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free. Persons with a hearing or speech disability with access to TTYTDD equipment can call 304-579-4827 not toll free. You dontheres a new employee benefit that takes the hassle out of payday.

This amount is also shown in box 1 of Form 1099-NEC. The independent contractor invoice template allows an individual or company to bill a client for work provided. There are also income exceptions that you do not need to report on Form 1099-MISC.

Save your time required to printing putting your signature on and scanning a paper copy of Form 1099-MISC. Form 1099-NEC call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free. TopNotepads 1099 invoice contactors invoice template is very simple to use and easy to issue.

Shows your total compensation of excess golden parachute payments subject to a 20 excise tax. Just add your details in the header section of the template. Independent Contractor 1099 Invoice Template.

Full service direct deposityour pay goes into the bank. Therefore payments should be made in full. Free 1099 Templates in Microsoft Word Format.

The 1099-nec word template free is an Internal Revenue Service IRS form used by businesses to report payments to independent contractors freelancers sole proprietors and self-employed individuals. A 1099-MISC form is an IRS tax form typically used by businesses to report miscellaneous non-salary income exceeding 600 paid to non-employees such as independent contractors consultants and landlords ie rent payments. See your tax return instructions for where to report.

The 1099-MISC form is also used to report prizes and awards such as those won on TV game shows as well as royalty. 1099 pay stub template - adp direct deposit form. Any fishing boat proceeds.

Step 1 Independent Contractor Completes IRS Form W-9. Download fillable Excel template spreadsheet to easily print onto IRS 1099 form with proper alignment 1099-NEC 1099-MISC1099-INT 1096. This invoice may be used for or any type of builder painter.

You can try to find a complete checklist on the IRS website. Shows income as a nonemployee under an NQDC plan that does not. Free 1099 template for printing.

The IRS imposes a high penalty per form that cant be processed by the IRS. These PDF files are for illustration only. Full service direct deposit automatically deposits your paycheck.

1099-NEC 1099-MISC Simple Excel spreadsheets Revised for 2021 IRS forms.

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Misc Form 2022 Fillable Blank 1099 Misc Form Pdfliner

Automate Form 1099 With Ai Rossum Leads The Way

1099 Misc Form Template Create And Fill Online

1099 Misc Form Template Create And Fill Online

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Printable Form 1099 Misc 2021 Insctuctions What Is 1099 Misc Tax Form

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

:max_bytes(150000):strip_icc()/1099-DIV2022-d0ba6b5ac8f74b89bf8cb5a6babe705c.jpeg)

Comments

Post a Comment